MCP Market Watch February 2026

Economy & Property Market Watch - February 2026

READ MORE >

Welcome to our debt advisory and finance broking service.

You can source information and tools, or get started below by submitting a Residential, SMSF or Commercial enquiry form, completing some background information. See Example

Use the loans tools, rate watch tables and resources provided to grow your knowledge or assist with your scenarios.

Our strategic partners, MCP Financial Services, have 25 years of experience in finance broking. Collectively we can:

For assistance, please contact us or MCP on 03 9620 2001

An introductory overview of the financial, legal and other issues that surround property acquisition or investment.

An introductory overview of the financial, legal and other issues that surround property acquisition or investment.

Challenges

Several acquisitions later, the business consisted of some customer bases transitioning to their branding and a few stand-alone firms at different locations. By the customer's admission, their banking strategy for growth was very aggressive but based on sound fundamentals.

However, the result was a collection of separate short-term financing facilities, with a repayment structure mismatched to the cash flow generated over the term. Hence, the customer lacked the necessary working capital to invest further in the business locations.

Strategy

MCP conducted a Business Review to assess working capital needs over the next three years and obtained a macro understanding of the business. With support from the customer's accountant, we analysed three years of customer financial forecasts and tested assumptions.

Results

Add Value

Despite a complete trading history with the same bank, a lack of consistency in Relationship Bankers meant the bank did not keep abreast of changing needs as the business evolved.

The unfortunate result was several separate financing facilities, with interest rates and loan terms not correctly matched to the purpose of the borrowings or the useful life of the assets. Plus, the frustration of an exhaustive credit application process each time the customer wanted to purchase a new truck.

Strategy

The customer requested a Business Review that included an assessment of their banking interests. MCP walked through 15 key questions to ensure a macro understanding of the business, analysed two years of financial performance and requested a 12-month forecast.

Results

Add Value

Our Customer

The customer is an experienced investor, holding a diverse range of commercial and industrial properties. A separate trading business is owned by multiple family members.

The customer was struggling to show the ability to raise finance for new and existing properties despite having a relatively low level of gearing, resulting in various separate lenders with different and time-consuming reporting covenants. Rates and fees were also expensive.

Strategy

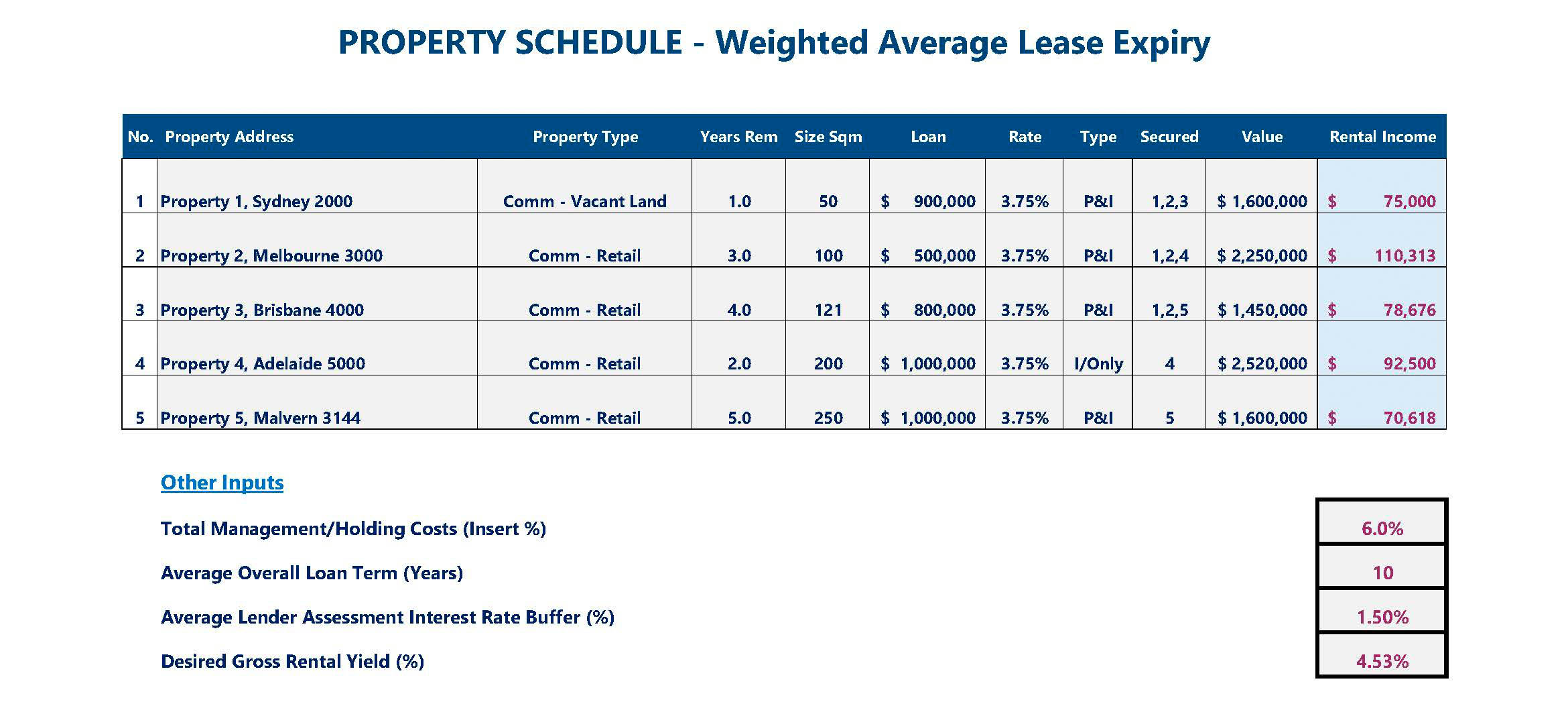

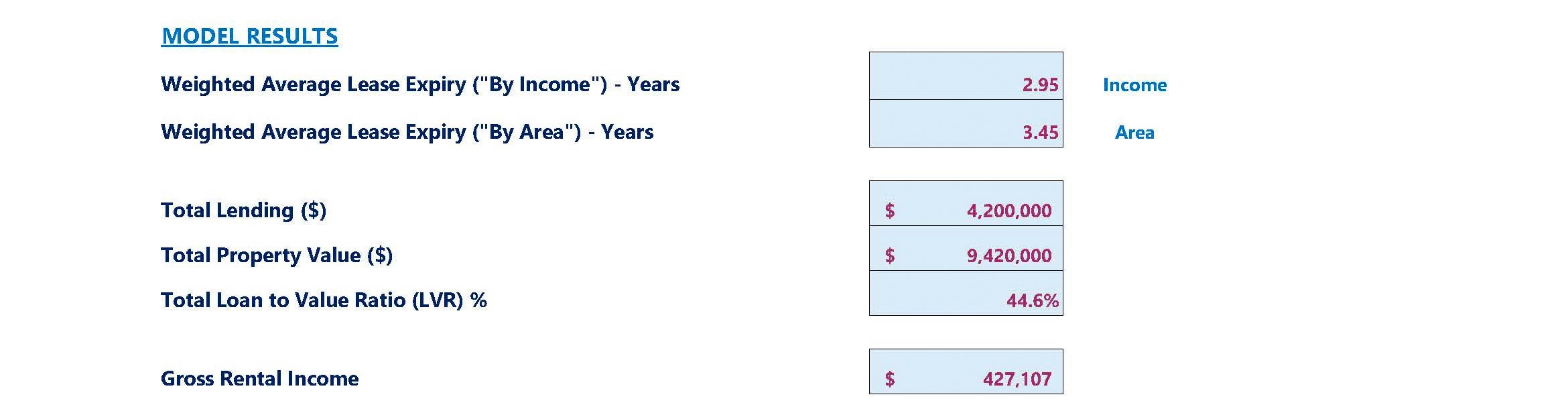

We helped our customer compile a property schedule that included an assessment of their "WALE" (Weighted Average Lease Expiry) by reviewing all existing property leases, gross income, and recent bank and independent valuation appraisals.

The initial findings were:

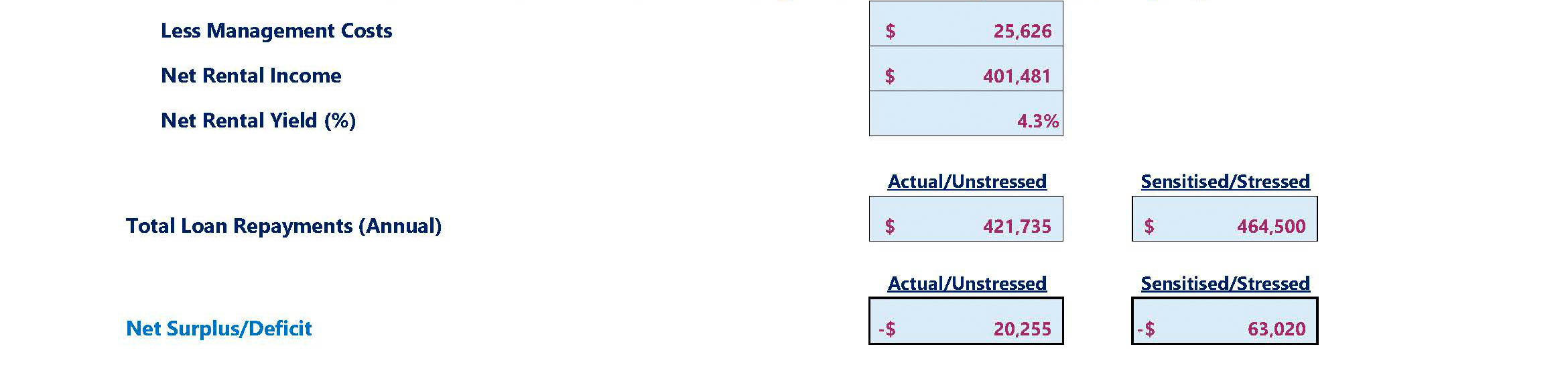

Results

Our review identified instances where incorrect data was communicated to credit providers. We demonstrated a more accurate overall financial position and drew attention to several mitigating credit factors.

From a credit perspective, the capacity to service debt was also strong and the interest rates charged were not reflective of that position.

Add Value

Better Working Capital Management for SMEs Working capital (WC) is known as the lifeblood of a...

READ MORE >Four banking trends all advisors need to know There are four trends in banking that Accountants and...

READ MORE >